April 16, 2024

Training Judges in a Triple Planetary Crisis

The escalating impacts of climate change, nature loss and pollution are pushing the boundaries of our legal system and climate litigation is increasingly being filed around the world by private and public actors alike. In the face of this triple planetary crisis, judges, as custodians of justice, find themselves adapting, innovating, and leading in unprecedented ways.

Read more about what our client, ClientEarth, one of the world’s most ambitious organisations, has been doing to address this.

March 8, 2024

#Global20 – Interview with Srishti Bakshi, Executive Director Global Philanthropic

On International Women's Day 2024, our latest Global 20 interview offers a timely reflection on the ongoing struggle for gender equality and celebrates the transformative efforts of women like Srishti Bakshi.

In this interview, Srishti sheds light on her remarkable journey in women's rights activism. The narrative unfolds with Srishti’s decision to leave corporate success behind and embark on a 3800km trek across India, championing equity for women globally. Her innovative use of art and digital media, including the creation of the award-winning documentary 'Women Of My Billion', underscores the power of technology in amplifying philanthropic initiatives. Delve into the full interview to uncover the depth of Srishti's narrative and explore the transformative potential of digital philanthropy.

February 4, 2024

Lady Edwina Grosvenor appointed Chair of Global Philanthropic’s Advisory Board

The Grosvenor Family are no strangers to philanthropy. With a longstanding track record of supporting charitable initiatives throughout their history, they continue to provide long term sustainable help and opportunities throughout the world.

Lady Edwina Grosvenor, sister of the 7th Duke of Westminster is a passionate advocate for prison reform and founder and Chair of One Small Thing, an organisation that aims to redesign the justice system. Her extensive philanthropic work most recently saw the opening of Hope Street in June 2023, a safe space for women to serve their sentences in the community alongside their children.

We are therefore delighted to announce that Lady Edwina has been appointed Chair of Global Philanthropic’s Advisory Board with immediate effect.

January 25, 2024

Global Philanthropic appoints new Executive Director, Europe & Asia

Global Philanthropic has announced that Srishti Bakshi has been appointed Executive Director Europe & Asia and Senior Consultant with effect from 18th January 2024.

A dynamic and accomplished professional with a track record of successfully designing and implementing projects that create systemic change, Srishti has a wealth of experience in storytelling, advocacy, and grassroots initiatives that have been at the forefront of challenging social norms, gathering evidence, and influencing policy.

January 15, 2024

Global Philanthropic announces new Chair

Global Philanthropic has announced that Martin Haigh has been elected the group’s new Chair of the Board with effect from 1st January 2024.

An early investor in Global Philanthropic, Martin’s involvement with the company began in 2000 and he has served on the Board for the last 15 years. His career as a stockbroker saw him head up trading teams dealing in the emerging equity markets of South America and Asia for some of the world’s largest institutional brokers such as HSBC, Banco Santander, Merrill Lynch and Standard Chartered. Having lived and worked in Hong Kong, more recently he has been pivotal in Asia event ticketing, working for Magnetic Asia as well as for the world’s largest promoter Live Nation as Head of Ticketmaster Asia.

December 11, 2023

A unique bequest society for a unique college

The St Beryl Society launched by Burgmann College this year takes it origins from the stuff of legend, when founding residents may or may not have “kidnapped” comedic duo Peter Cook and Dudley Moore from the Canberra Airport on 13 September 1971.

While the kidnapping part is most certainly mythic, the enterprising group of ardent fans did gatecrash the press conference for the pair’s famous 'Behind The Fridge' tour, and did successfully persuade them to come to a celebratory dinner in the College Dining Hall. Read on to discover more about how we worked with the College to develop its bequest communications and provide advice for the launch of the St Beryl Society.

December 3, 2023

#Global20 – Interview with Dr Ruth A Shapiro, Co-founder and CEO of CAPS

This thought-provoking Global 20 interview with Dr Ruth A Shapiro, Co-founder and CEO of Centre for Asian Philanthropy and Society (CAPS), provides a comprehensive overview of Asian philanthropy, its unique characteristics, challenges, and the potential it holds for shaping a sustainable future.

The conversation delves into the unique aspects of Asian philanthropy, including the strong influence of government and the significant role of family businesses. The community-centric approach of Asian philanthropists, focusing on relationships and addressing specific community needs, is discussed in fascinating detail.

August 2, 2023

#Global20 – Interview with Cindy Forde, Co-founder Planterai and Kando

Ultimately, all it takes to achieve a brighter future for the planet is a shifting of our collective thinking and actions as a human family. But where to begin? Author and activist Cindy Forde is starting young by enlightening children about important environmental issues and how they can be mitigated and fixed.

In doing so, she is helping to prevent the burden of despair that can come with being born into a world that is facing possibly the most challenging periods of human history. Cindy’s book ‘Bright New World’ takes a child’s hand and guides them through the kind of world we can have.

In this Global20 interview she talks to our Group CEO, Ben Morton-Wright, about operating in line with the planetary boundaries. Explaining how intervention and digital innovations can be supported by philanthropy and radical collaborations, Cindy's interview is extremely powerful and instills hope for a more optimistic and positive future.

June 28, 2023

#Global20 – Interview with Robin Millington, CEO, Planet Tracker

As the Pacific Ocean transitions from a three-year cooling period known as 'La Niña,' during which the highest temperatures ever recorded were observed, it is now entering an 'El Niño' phase, causing a rise in temperatures once again. Robin Millington, the CEO of Planet Tracker, discusses the significant implications this will have on global food production.

In this Global 20 interview, Robin emphasises the role philanthropic funding can play in addressing the challenges related to food supply, and highlights the increasing responsibility of large food companies in the face of climate change-driven pressures on our food production.

June 11, 2023

#Global20 – Interview with Emma Beeston, Philanthropy Advisor

The realm of philanthropy presents abundant opportunities to support inspiring people and organisations dedicated to driving social change. It can also be full of a daunting number of choices regarding how and where money can make a positive impact.

The role of a philanthropy advisor guides philanthropists through all the options, yet it can be likened to a film producer - behind the scenes, often unknown, yet integral to a blockbuster movie!

In this Global 20 interview, our CEO and Founder Ben Morton-Wright talks to Emma Beeston about her new book 'Advising Philanthropists', which she co-authored with Beth Breeze. They discuss the emergence of philanthropy advising as a not-at-all fluffy profession, unpack how the sector is evolving with collective collaboration and Emma’s optimism for the younger generation creating impact with their lives.

June 7, 2023

Is philanthropy recession-proof?

With a potential global recession on our doorstep, what lessons can we apply to the current situation and how can we build sustainability and future-proof philanthropy?

In his blog post Lincoln Size explores what history teaches us and how the answer lies in changing our mindset to giving. The days of rattling the tin are over!

June 6, 2023

#Global20 – Interview with Dr Doug Gurr, Director, Natural History Museum

In the latest of our Global 20 series, we are privileged to bring you a penetrating interview with Dr Doug Gurr, Director of the Natural History Museum in London. Formerly Global Vice-President and Head of Amazon UK, and Chairman of the British Heart Foundation, Doug is highly respected for his visionary leadership and recognised globally for his remarkable contributions to the realms of technology, business, and public service.

In this deeply compelling interview, Doug talks to our Chair Iain Rawlinson about his journey from the corporate to non-profit world, the ground-breaking work being carried out that measures the pristine natural biodiversity on the Earth’s surface, and the pressing challenges posed by the threat of a sixth mass extinction.

Do listen or watch until the end as Doug imparts his belief that there is hope for the future as a path is found where global economic growth is still possible without over consuming the Earth's precious and natural resources, whilst emphasising the collective responsibility in this endeavour.

May 23, 2023

Announcing our new Honorary Chair, Europe

We are thrilled to announce a promotion within our organisation. Our President of Global Philanthropic Europe, Dr Pam Davis, will move to a new role of Honorary Chair from January 2024.

As an integral member of our team, Pam has consistently exemplified the highest standards of professionalism, strategic vision, and unwavering commitment to the charitable sector and philanthropic community. Her valuable contributions, innovative thinking, and exceptional guidance have also significantly shaped our company’s success.

May 16, 2023

New Global Philanthropic Europe Senior Leadership Vacancy

Are you a highly driven and experienced leader? As our global business grows we are excited to announce an opportunity for an exceptional individual to join Global Philanthropic as a senior member of our Europe team. Highly networked with extensive experience working in the philanthropic arena, the successful candidate will be a strategic thinker who will be pivotal in leading our team in delivering outstanding service to our clients, developing innovative programs and maximising revenue generating opportunities.

The successful candidate will be joining us at an exciting time of unique challenge and opportunity.

May 1, 2023

#Global20 – Interview with Douglas Gautier, CEO & Artistic Director, Adelaide Festival Centre

Many of the best cultural organisations and art centres worldwide are very cognisant of their responsibility to diversity and accessibility. With Australia being one of the most multicultural communities on the planet, Douglas Gautier, CEO and Artistic Director of Adelaide Festival Centre knows only too well where arts and culture flourish generally, so does harmony and tolerance and a better understanding of walking in somebody else's shoes.

In this interview our Vice President of Australia, Lincoln Size, talks to Douglas about how philanthropy has contributed to the arts and culture in Australia, examines the role of corporates in arts philanthropy and asks what advice he would give to philanthropists who may be wondering how to have the greatest impact with their support of the arts.

April 16, 2023

Medical Research and Translation: The intersection of government and philanthropy

Whilst Australia is a world leader in medical research, it still has challenges in moving new ideas through the research pipeline to become new medicines, therapies and services that improve health. In this article discover more about the symbiotic relationship between government, business and philanthropy and how extraordinarily generous donations by some of the nation’s wealthiest residents and donors is helping to bring long-term societal change and eradicate diseases.

March 22, 2023

Working with IFAW to help fund pioneering and innovative ways to help all species flourish.

IFAW (International Fund for Animal Welfare) is a global non-profit organisation helping animals and people thrive together. Working across oceans, and in more than 40 countries around the world, IFAW rescues, rehabilitates and releases animals, restoring and protecting their natural habitats. Conservation problems today are urgent and complicated; to help solve them, IFAW matches fresh thinking with bold action.

March 9, 2023

Turning purpose into action with CSR and ESG

Many a company has jumped on the Corporate Social Responsibility (CSR) and Environmental, Social and Governance (ESG) bandwagon to legitimise their social responsibility. But in doing so, have they delivered meaningful social impact, or merely marketed their social credentials to enhance employee engagement and brand?

March 2, 2023

#Global20 – Interview with Mark Ruffo, Chief Development Officer, Landesa

Around the world nearly 2.5 billion people rely on land for their livelihoods yet many do not have the tenure to their land necessary to thrive. Securing land rights for the world’s poorest people is the work of Landesa, who in 2022, received a $20 million gift from philanthropist MacKenzie Scott.

In this interview we hear from Mark Ruffo, who explains why they don’t accept government funding, their capacity building in the Global South and how they are uniquely positioned to help 400 million rural women realise the benefits of strength and land rights by 2027.

February 23, 2023

Why Hope Street in Hampshire is trailblazing a pioneering residential community for justice involved women

We were greatly inspired by our recent visit to Hope Street in Hampshire, a trailblazing new service that will prevent women from receiving short prison sentences for non-violent crimes that can result in separation from children.

January 25, 2023

#Global20 – Interview with John Pepin, Chief Executive, Philanthropy Impact

Recent times have seen a massive jump in the amount of data and insights available. Quality research data is providing powerful and indisputable evidence, none more so in the philanthropic sector than that from Philanthropy Impact.

In this interview John delves in to the sometimes-confusing terminology used in philanthropy, HMRC's research on giving trends and what philanthropists really expect from their advisors.

January 10, 2023

London Southbank University in a more confident place

London Southbank University (LSBU) have been transforming lives, communities, and businesses for over 120 years. As they adapt to a new Group structure and take full advantage of the digital age embracing innovation and sustainability, they approached us to support their ambitions to be fit for the future. LSBU are now in a more confident place after we supported them to think through fundraising strategies and begin to develop fundraising approaches for both student support and academic research.

December 12, 2022

#Global20 – Interview with Dame Stephanie Shirley CH, Businesswoman and Philanthropist

Over the course of the last 30 years, Dame Stephanie has given away almost £70 million to good causes.

In this interview, Dame Shirley talks about important role of women in philanthropy, Venture Philanthropy, and how she approaches and focuses her giving, investing strategically in projects that will benefit from her time or insight, as well as her money, to maximise positive outcomes.

November 23, 2022

#Global20 – Interview with Professor Frances Corner OBE, Warden of Goldsmiths

As part of our 20th anniversary celebrations, we are sharing 20 interviews with leaders in philanthropy and the nonprofit sector. Here Nick Jaffer, President and CEO, Global Philanthropic (Asia Pacific), interviews Professor Frances Corner OBE, Warden of Goldsmiths, University of London.

In this interview, Professor Corner talks about the role of education in transforming peoples lives, Goldsmiths' commitment to diversity and community, and its initiative around art for social good.

November 9, 2022

Why Planning For Endowment Is So Important

On 4th November 2022, Arts Council England (ACE) announced which organisations have gained or lost National Portfolio Organisation (NPO) status. NPOs will receive three-year funding support from ACE, starting in April 2023 and decisions were made in line with the government policy of “Levelling Up”. Funding of £446M will be shared by a total of 990 arts and culture organisations; but many organisations heard the unwelcome news that they would be receiving less funding, or none at all.

November 6, 2022

Building a bigger vision with Burgmann College

The heart of Burgmann College is its egalitarian ethos and deep belief in the value every member brings to its community.

This unique not-for-profit residential college, supporting students of the Australian National University (ANU) in Canberra, holds relationship at its core. Yet, it was hesitant to explore amongst its community the potential for philanthropic support.

October 24, 2022

#Global20 – Interview with Geoff Holt MBE, DL Yachtsman and Disability Sports Ambassador

As part of our 20th anniversary celebrations, we are sharing 20 interviews with leaders in philanthropy and the nonprofit sector. Here Ben Morton-Wright, Global Philanthropic Founder and Group CEO, interviews Geoff Holt MBE, DL, Yachtsman and Disability Sports Ambassador.

In this interview, Geoff talks about the challenges facing charities in the disability sector, the importance of brand and how The Wetwheels Foundation has structured its model as well as its strategic long term thinking and development plan.

September 25, 2022

#Global20 – Interview with Prof David Lalloo, Director, Liverpool School of Tropical Medicine

#Global20 - Interview with Prof David Lalloo, Director, Liverpool School of Tropical Medicine.

As part of our 20th birthday celebrations, we are sharing 20 interviews with leaders in philanthropy and the nonprofit sector. Here Ben Morton-Wright, Global Philanthropic Founder and Group CEO, interviews Professor David Lalloo, Director of Liverpool School of Tropical Medicine (LSTM).

July 17, 2022

#Global20 – Interview with Lord Simon Woolley, Principal of Homerton College, University of Cambridge

#Global20 interview with Lord Simon Woolley, Principal of Homerton College, Cambridge and Pam Davis, President, Global Philanthropic (Europe). In this interview, Lord Woolley explains how philanthropists can empower beneficiaries and allow them to be the experts in making impact.

July 14, 2022

#Global20 – Interview with Griff Green, Co-Founder Giveth

#Global20 interview with Griff Green, Co-Founder of Giveth and Ben Morton-Wright, CEO, Global Philanthropic on the future of cryptocurrencies and this new area of development in philanthropic transactions.

March 28, 2022

#Global20 – Interview with James Thornton, Client Earth

#Global20 interview with James Thornton, CEO, Client Earth. James and Pam discuss environmental philanthropy and the impact of a nonprofit using the law to protect the earth.

March 15, 2022

#Global20 – Interview with Hans Pung, RAND Europe

#Global20 interview is with Hans Pung, President, RAND Europe. Hans and Matthew discuss the long term impact the pandemic could have on education for this generation of youth and the impact of mental health on society during the pandemic.

March 4, 2022

Korea Business News Interview – The Business of Philanthropy

In December 2021, Global Philanthropic Asia Pacific President and CEO Nick Jaffer discussed the business of philanthropy with Mr Bruce Han on Korea Business News (KBN)

March 4, 2022

The Future of Philanthropy

I was recently asked by a large foundation to give my view of the future of philanthropy as part of a study. This prompted me to ask my colleagues at Global Philanthropic to join in a collaborative debate on the subject. Here is our thinking.

March 2, 2022

A Formidable Fundraiser, Sir Duncan Rice

A formidable fundraiser, Sir Duncan Rice. Global Philanthropic pays tribute to the chair of its European business.

February 2, 2022

What is Corporate Philanthropy and why is the S in ESG too important for businesses to ignore?

Interview with Iain Rawlinson, Chair of Global Philanthropic Holdings on Corporate Philanthropic and why the S in ESG is too important for businesses to ignore.

Interview undertaken by Kirsty Lang in 2021.

January 20, 2022

#Global20 – Interview with Lady Edwina Grosvenor

Our first #Global20 interview is with Lady Edwina Grosvenor. She is an English philanthropist and prison reformer. She is the founder and trustee of the charity The Clink, and founder of the charity One Small Thing. Lady Edwina Grosvenor shares what drives her as a philanthropist and what lessons we can learn, from her experience and journey with philanthropy.

January 19, 2022

Global Philanthropic celebrates 20 years

We are thrilled to share that 2022 marks Global Philanthropics 20th birthday and to celebrate this milestone year we will be sharing 20 interviews.

October 18, 2021

Webinar transcript – Donor Stewardship: the key to success

This webinar focused on donor stewardship, tailored from minimum best practice standard to aspirational levels, to suit every scale of operation.

October 8, 2021

GP Europe welcomes new team members

Global Philanthropic is delighted to announce the strengthening of its European team with a series of new appointments this autumn.

October 7, 2021

Malcolm Hutton appointed Honorary President of Global Philanthropic

Malcolm Hutton's contribution, since the formation of the company nearly twenty years ago, has been quite phenomenal. We are delighted to announce on behalf of the Global Philanthropic Board and staff that Malcolm is appointed our first ever Honorary President.

September 7, 2021

Higher education – Unlocking philanthropic opportunities

There are important lessons which have come out of the pandemic for higher education organisations, lessons which are important to keep top of mind as we continue to move forward, and lessons which will continue to be as important post-pandemic as they were during.

May 15, 2021

Global Philanthropic honours three leaders in philanthropy at Talking Philanthropy 2021

Congratulations to this year's Philanthropy Award Winners, Fran Perrin, Dexter Yang, and Marcus Rashford.

May 10, 2021

10 steps to engage your Board for better fundraising

Does your board engage in fundraising and take responsibility for your organisation’s revenue and growth? Or are they passive, or even invisible, in this process?

If you feel your board could do more, you’re not alone. The good news is, there are solutions to these challenges.

April 26, 2021

4 ways family businesses can lead the pandemic recovery

COVID-19 pandemic has revealed an intergenerational crisis and urgent need for a better model of capitalism.

With its long-term vision, stewardship and values-driven strategy, the family business model can be part of the global solution.

April 20, 2021

How COVID-19 Is Shifting the North-South Philanthropic Power Dynamic

Sociologist Erving Goffman suggested that the best time to understand social interaction is when it’s disrupted. This may also be true of philanthropy, and the field is certainly experiencing disruption today.This has highlighted the historically unequal power dynamic that exists between philanthropic organizations in the Global South and resource-rich foundations of the Global North.

April 9, 2021

5 Ways To Make Your Giving Transformational

If you want your philanthropy to help change the world, you might need to change how your funding is structured. In addition to disrupting longstanding power dynamics between grantor and grantee, the way you structure your funding should align with the type of impact you wish to see. Here are five different approaches to funding that will help you—-and your partners—-increase your impact velocity.

April 7, 2021

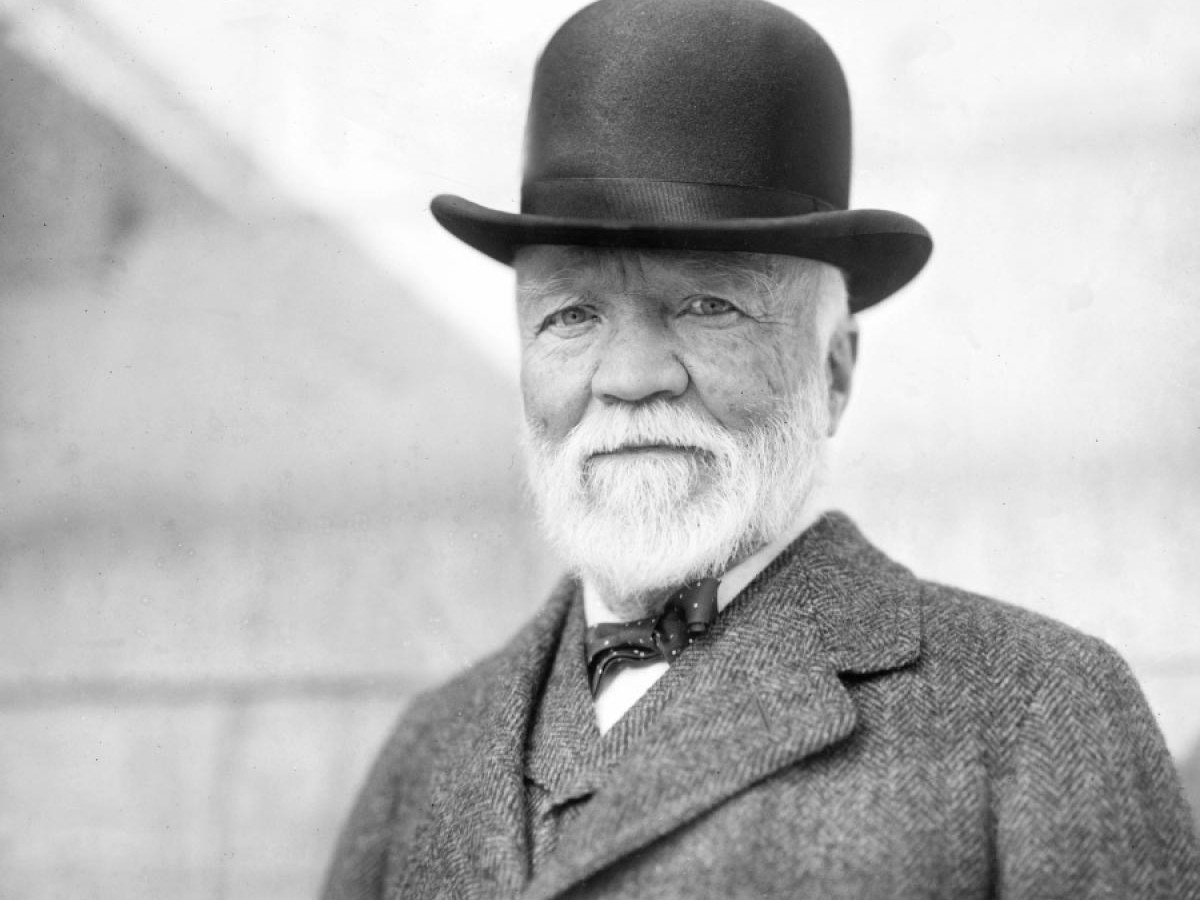

Your philanthropic journey – what we can learn from the father of modern philanthropy.

Andrew Carnegie was one of the most successful businessmen and most recognised philanthropists in history. How can he guide our philanthropic journey?

March 1, 2021

Our authentic selves and doing diversity right.

Donors are already changing. For fundraisers, investing in diversity and inclusion means to change the established fundraising system that caters largely to white male donors and apply more adaptive and empathy-based practices to engage ever diversifying donor communities.

February 5, 2021

Underused and overlooked: harnessing LinkedIn as a strategic tool for fundraising

I developed, adapted and continue to fine-tune my presentation on how to strategically use LinkedIn—the free version—for fundraising purposes. I have now shared this knowledge in several countries, and always with very positive feedback. Let me give you the basics.

January 13, 2021

Will The Ongoing Global Pandemic Usher In A New Era Of Corporate Philanthropy?

A corporate philanthropic approach goes far beyond mere ESG compliance, and neither is it a reworked version of old-style CSR. It is a new approach, intended to address the deep social inequalities which were present before, but have been widened by, the pandemic.

December 15, 2020

Global Welcomes Iain Rawlinson as Director and new Chair

Global Philanthropic warmly welcomes Iain Rawlinson as Director of the Board and the new Chair of the Global Philanthropic Group, starting in January 2021. Iain is an experienced Board Member & Chair, charity trustee and strategy adviser. He brings a wealth of expertise to help Global Philanthropic meet our 2021 goals and help us serve our clients better.

December 11, 2020

A New Chapter For Asian Philanthropy

The roles governments, NGOs, philanthropists and the charity sector play in nurturing a philanthropy ecosystem across the Asia-Pacific region will drive the conversation at the fourth annual Talking Philanthropy forum hosted by the international fundraising advisory firm Global Philanthropic.

November 24, 2020

Philanthropy and the Corona reset

The global pandemic has reset so much of our society and the way we operate across the word. It has also had a profound impact on philanthropy. What we have witnessed is a recalibration of our awareness of human interdependence and our own vulnerability. Philanthropists have stepped up to the challenge of Covid19 in many different ways.

October 28, 2020

Reaching their full fundraising potential: Canberra Hospital Foundation success story

The Canberra Hospital Foundation sought Global Philanthropic’s expertise in research and fundraising strategy to inform the case for moving to an independent entity. The Foundation needed evidence that the move would be viable and, if it was, how it could be implemented for the best efficiency and effectiveness.

October 28, 2020

10 ways to optimise your resources with a fundraising consultant

I was previously the director of a rapidly growing fundraising department in a major university, and before that the executive director of a non-profit organisation. Now that I’ve just completed my second year as a consultant, I’ve learnt one or two things along the way I wish I’d known back then. And I’m happy to share!

October 28, 2020

The benefits of benchmarking

When you and your organisation are setting goals for your new fundraising endeavours—be it for your start-up fundraising operation, your augmented major or principal giving programme, or launching in a new country or region—you will have many questions, one of which will be, ‘What are our peers doing?’

October 15, 2020

Developing your compelling Case for Support

Understanding and articulating your Case for Support to donors can be challenging—we can suffer the curse of too much knowledge or, alternatively, be too close to the coal to see the broader scope of our vision. Yet getting this step right is not only critical to our fundraising success but can make our role as fundraisers so much easier.

April 24, 2020

Fundraising during COVID-19: Time for decisive yet measured action

Yet while the familiar major gift cycle for principal donors is almost the same as for major donors, it is important to realise there are some subtle but critical differences.

January 20, 2020

It’s never too late—or too early—to start your endowment fund

An effective but underutilised vehicle to channel this wealth is an endowment. Endowments are donations made to non-profit organisations with the intention of investing to earn income. This allows the donations to keep giving long into the future.

October 9, 2019

7 tips for preparing for and managing principal gifts

September 27, 2019

Asia – Relationship fundraising and political risk

To understand Asia, you need to understand the importance of relationships, and to do successful fundraising, you need to be good at relationship management.

September 18, 2019

Oceans of Accessibility

Holt was paralysed from the chest down after diving off a boat into shallow water on a holiday when he was 18 years old. He is confined to a wheelchair and has minimal movement in his arms and fingers. But he refuses to let his disability define him.

June 13, 2019

Match, pace, lead – the athlete’s approach to major gift asks

Match, pace, lead mirrors the martial arts philosophy of going with the direction of the movement and using the energy of your partner to take them to where you want them to be. How can you use this in fundraising?

January 25, 2019

Webinar on Asian Philanthropy by Ben Morton Wright

Presented by Ben Morton-Wright, this class will focus on differences of fundraising in Asia compared to Europe and the US, the importance of family and intergenerational giving (family philanthropy and how it is embedded in Asian culture), regional complexities and future opportunities, and recent stats on giving in the region and its implications.

Stay informed!

Sign up to get the latest philanthropic updates in news, events, and articles.

Don't miss the latest blogpost.

Sign up to get the latest blogpost directly to your inbox.